Chart Patterns Cheat Sheet [FREE Download]

Breakout patterns can occur when a stock has been trading in a range. The top of the range is resistance, and the bottom is support. If the stock breaks through either end of this range, it's a breakout. When it breaks above resistance, we call it a breakout. Below support is a breakdown. Learn more about breakout trading here.

BREAKOUT PATTERNS Trading charts, Chart patterns trading, Forex trading quotes

08:00 AM ET 08/31/2022 If you're looking for stocks to buy, first learn to recognize certain patterns in a stock's chart. IBD identifies these as proper bases, which give the stock a clear.

How To Avoid False Breakouts 5 Key Tips You Should Definitely Know

These patterns can mark reversal breakouts or continuation breakouts. The chart above shows Corning (GLW) with a reversal Quadruple Top Breakout in February 2009. This reversal pattern also resembles an inverse head-and-shoulders. The second Quadruple Top Breakout is a bullish continuation pattern.

Page 348 12 — Education — TradingView

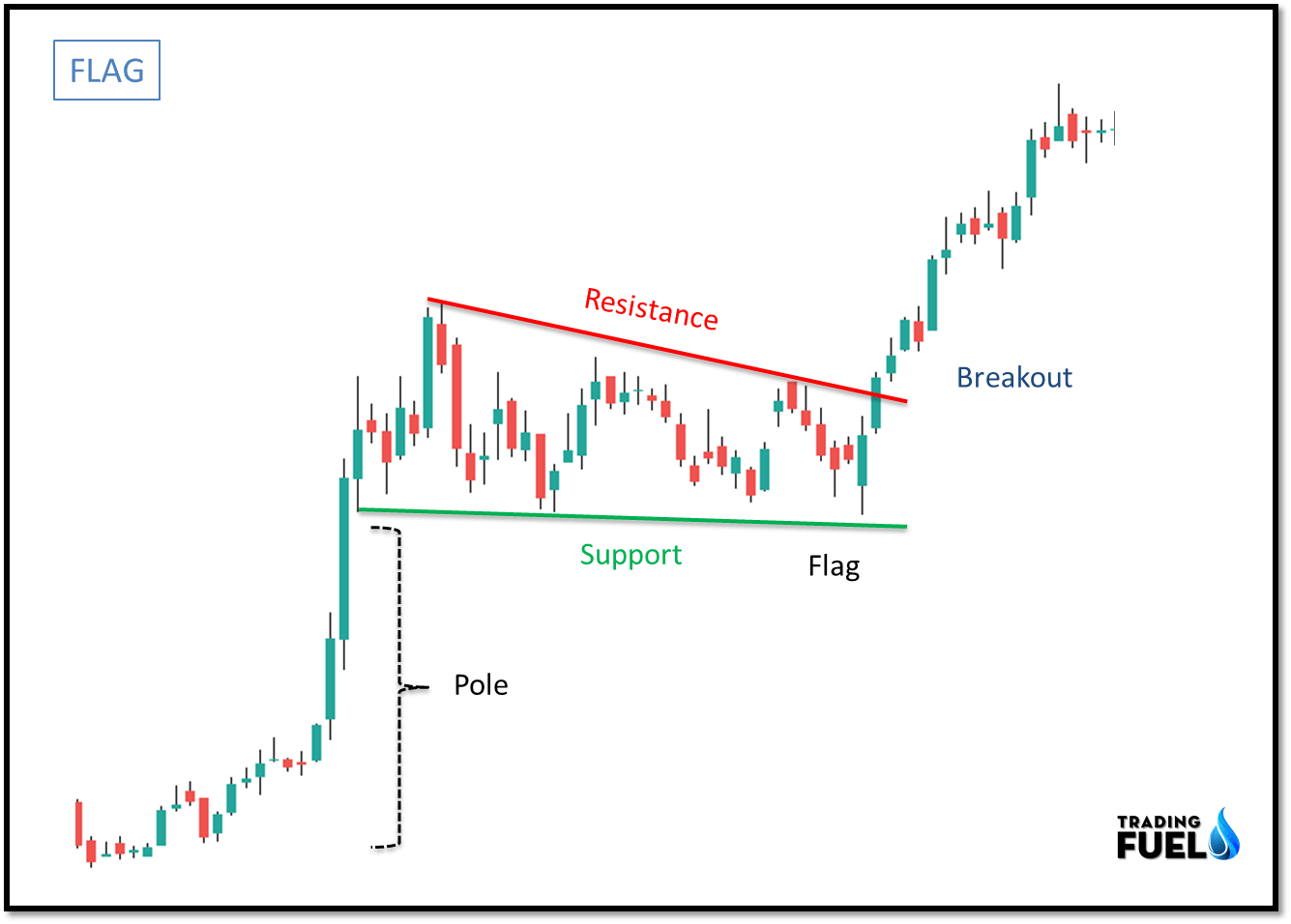

Breakouts are commonly associated with ranges or other chart patterns, including triangles, flags, wedges, and head-and-shoulders. These patterns are formed when the price moves in a.

Triangle Pattern, Flag Pattern & More.. (Continuation Chart Pattern Part4)

Breakout candlestick patterns are essential tools for traders who are looking to capitalize on significant price movements. These patterns provide valuable insights into the market's sentiment, and when combined with other technical analysis techniques, they can be powerful indicators of upcoming price breakouts. Mastering the identification and interpretation of breakout candlestick.

What Is A Breakout/Breakdown How To Trade Breakouts Trade Options With Me

Breakout chart patterns are the last phase that stocks go through. First there is the oversold pattern, next the continuation pattern, and then the breakout chart pattern. Traders that bought on the oversold pattern and continuation pattern often take profits on the breakout chart pattern.

:max_bytes(150000):strip_icc()/dotdash_Final_Breakout_Definition_and_Example_Nov_2020-01-0143a5a8cd1a4fbd9433afe51482d6ea.jpg)

Breakout Definition and Example

Breakout patterns are a popular trading strategy used by investors to identify potential profitable trades.

Triangle Chart Patterns Complete Guide for Day Traders

A breakout stock is simply one that has a quick (and often short-lived) period of volatility, either to the upside or downside. Most traders consider a breakout to be a bullish trend, but.

The Best Breakout Trading Strategy Trade Room Plus

Complete. Chart patterns on altFINS are classified as Emerging or Complete (breakout): Emerging: when price still trades between the support and resistance lines. So emerging patterns are technical trade setups that have yet to break out. Complete (breakout): when price has broken through the support or resistance line.

Triangle Chart Patterns Complete Guide for Day Traders

INTRODUCTION This is a short illustrated 10-page book. You're about to see the most powerful breakout chart patterns and candlestick formations, I've ever come across in over 2 decades. This works best on shares, indices, commodities, currencies and crypto-currencies. By the end you'll know how to spot:

an image of price chart breakout patterns

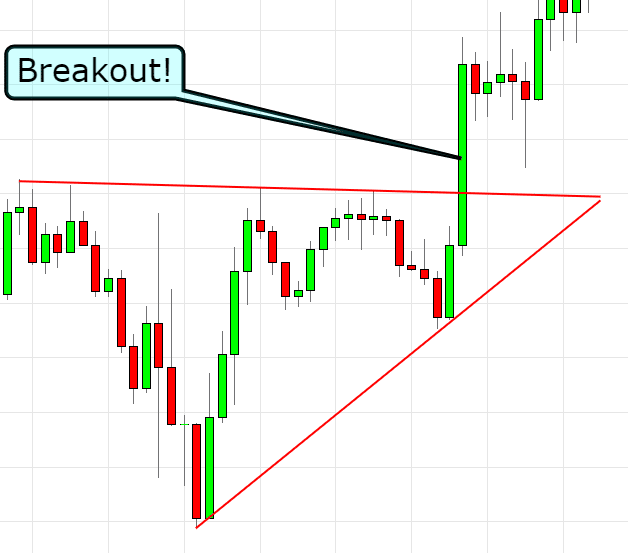

There are three breakout patterns that have gained popularity among traders: the triangle pattern, the rectangle pattern, and the head and shoulders pattern. The triangle pattern: Formed when the price moves within converging trendlines, creating a triangular shape on the chart.

Trading with chart patterns, Breakout strategy. internationaltrading (Có hình ảnh)

A breakout trader enters the market long or short when the stock price breaks above resistance or below support. When a stock trades over a price barrier, volatility rises, and prices usually move in the breakout direction.

Breakout Trading Pattern Strategy Learn This Simple Strategy!

A pattern is bounded by at least two trend lines (straight or curved) All patterns have a combination of entry and exit points Patterns can be continuation patterns or reversal patterns Patterns are fractal, meaning that they can be seen in any charting period (weekly, daily, minute, etc.)

Breakout Chart Patterns December 10

A price pattern is a recognizable configuration of price movement identified using a series of trendlines and/or curves. When a price pattern signals a change in trend direction, it is known as.

Analyzing Ascending Triangle Chart Patterns

This target price of $25 is calculated by taking the height of the pattern of $2.60 ($22.40 - $19.80) and adding it to the entry price of $22.40. Image by Sabrina Jiang © Investopedia 2021 You.

Breakout Chart Patterns & Trend lines A Practical Book PDF Free Download

A rectangle is a chart pattern formed when the price is bounded by parallel support and resistance levels. A rectangle exhibits a period of consolidation or indecision between buyers and sellers as they take turns throwing punches but neither has dominated.